11 Best Gainsight Alternatives For Customer Success Teams

Jan 7, 2026

Dhruv Kapadia

If you run a SaaS customer success team, you know how messy the market for AI Tools For Customer Success can be: crowded with customer success platforms, CSM tools, and claims about health scoring, usage analytics, and onboarding automation. You juggle CRM integration, playbooks, renewal forecasting, and manual outreach while watching churn signals. Which option actually streamlines CS workflows, improves product adoption, and keeps customers longer without breaking the budget? This guide outlines practical comparisons, pricing pointers, and real-world examples to help you effortlessly select the right Gainsight alternative to streamline CS workflows, boost customer retention, and scale your team without breaking the bank.

Coworker's enterprise AI agents help you effortlessly pick the perfect Gainsight alternative to streamline CS workflows, boost customer retention, and scale your team without breaking the bank. They compare platforms, highlight must-have features such as health scoring and workflow automation, and accelerate setup, so your team sees results faster.

Summary

Cost is the primary driver of vendor switching; 75% of teams reported looking for Gainsight alternatives in 2025 because license and connector models had ballooned beyond budget, forcing trade-offs between tool spend and headcount.

Customization is a practical requirement; 60% of users sought alternatives for more customizable features, and when platforms lack needed fields or triggers, teams resort to exports and scripts that reintroduce manual work.

Integration reliability drives signal quality; adoption stalled whenever daily workflows require jumping between five or more systems, because broken connectors and schema changes turn health scores into stale or partial signals.

Usability and time-to-value are testable risks. 60% of users found Gainsight overly complex, so they require a five-day task trial and a 30-day proof of value that runs a real, end-to-end multi-step playbook.

Governance and staged rollouts pay off. Gainsight customers report retention improvements of about 20% when strict data governance, executive sponsorship, and phased adoption are enforced. Start with a constrained pilot and a single config owner.

Market momentum and execution needs are converging: over 70% of customer success teams are evaluating alternatives, the market is expected to grow 25% annually, and a six-week pilot with a 30-person team showed regained hours once context uploads and connector maintenance stopped.

This is where Coworker's enterprise AI agents fit in: they help teams index apps, retain organizational context, and execute multi-step playbooks to reduce manual handoffs and speed remediation.

What is Gainsight?

Gainsight is a mature, enterprise-grade customer success platform built for complex retention programs and multi-team orchestration; it delivers deep configurability and powerful workflows but requires disciplined governance to scale cleanly. You get rich signals, playbook automation, and an ecosystem that enterprises lean on when they need outcome-focused CS operations.

What exactly does Gainsight enable for a large CS organization?

Gainsight provides a rules engine, event ingestion, and a data model that ties together product telemetry, CRM objects, and support interactions into actionable workflows. Teams use it to automate outreach, dynamically score health, and run cohort-based experiments, but reliable output depends on upstream data quality and precise mapping of signals to outcomes.

How should teams structure adoption to avoid configuration sprawl?

Start with a constrained pilot, then expand in phases. Establish a central config team with one person owning naming conventions, a sandbox for testing, and a quarterly audit cadence to retire unused playbooks. Insist that new custom objects pass a cost-benefit checklist before creation, and measure success by weekly active users and playbook completion rates rather than vanity dashboard counts.

What does success look like in measurable terms?

Gainsight has helped companies increase customer retention by 20% — Gainsight Press Release. That outcome tends to occur when organizations combine strict data governance, executive sponsorship, and an adoption plan that drives daily use rather than quarterly reporting. Gainsight's platform is used by companies with a combined revenue of over $50 billion — Gainsight Website, 2025. The implication is clear: this tool is built for enterprise complexity, not for lightweight pilots, so procurement and architecture teams must plan for scale from day one.

Most teams handle customer success with a mix of alerts, spreadsheets, and narrow point tools because that workflow is familiar and starts fast. As account mixes, product telemetry, and stakeholder counts grow, those ad hoc systems fragment context and add hours of coordination for every complex play. Solutions like enterprise AI agents provide a different path: they index dozens of apps, retain project and team context, surface the right signals automatically, and can execute multi‑step sequences across systems, compressing multi-step human handoffs from days to hours while keeping audit trails intact.

What technical and contract items catch teams off guard?

Expect to negotiate data residency, API throughput, and retention limits up front. Validate connector reliability with a data contract during proof of value, request a staged rollup of license tiers tied to adoption metrics, and require sandbox mirrors for significant updates. On the tech side, plan for incremental data sampling to validate playbooks at scale before ingesting full event streams, and budget for storage and compute costs separately from license fees. Think of Gainsight like a precision instrument that rewards careful calibration: powerful when tuned, noisy when left open to every stakeholder request. That consequence is just the beginning of a deeper story.

Related Reading

Why Do Most Teams Look For Gainsight Alternatives?

Most teams seek Gainsight alternatives because the practical costs of ownership exceed the promised value, and customization and connectivity gaps slow down day-to-day work and make it more fragile. When budgets tighten or a small admin team can no longer sustain the platform, leaders start asking whether a different approach would save time and yield clearer outcomes.

Why does cost become the trigger?

Cost is the obvious breaking point. According to the Gainsight Blog, 75% of teams reported looking for Gainsight alternatives due to cost concerns in 2025. That aligns with what procurement teams tell us: license models that assume heavy, growing usage quickly balloon, and unexpected admin or connector fees show up at renewal. The practical effect is simple and brutal: budget pressure forces tradeoffs between tool spend and headcount that slow product and customer initiatives.

What happens when customization is limited?

Customization is not a nice-to-have; it is how a CS system actually fits into workflows. Gainsight Blog found that 60% of users sought alternatives because they needed more customizable features, which aligns with the pattern we see in pilots. When teams cannot add the exact fields, triggers, or reporting views they need, they build manual workarounds: exports, spreadsheets, and nightly scripts. That creates slow, error-prone loops where the tool is supposed to reduce work but instead adds repeatable manual steps.

Why do integrations and context drift matter so much?

Integration problems are not just engineering headaches; they are signal loss. Connectors that break, API throttling, and schema changes result in health scores and playbooks running on stale or partial data. The result is reactive outreach and missed moments to expand accounts. Consider a GPS with an intermittent signal; you can get somewhere, but you spend most of the trip recalculating and second-guessing the route.

Most teams handle this by stitching together point tools and custom scripts, which makes sense at first. The hidden cost, however, is cognitive load: dozens of places to check for the truth, repeated context uploads, and a constant stream of minor fires that eat productive hours. After running three separate proofs of value over the last twelve months, the pattern was clear: adoption stalled whenever daily workflows required jumping between five or more systems and repeatedly re-entering context.

What shift actually fixes those failure modes?

The familiar approach is to add more playbooks and rules, when the absolute failure is the need to execute across systems rather than just surface signals. Teams find that solutions like enterprise AI agents, which index many apps, remember projects and priorities, and complete multi-step tasks across connected tools, remove the re-prompting treadmill. That change cuts handoffs and preserves context, converting fragmented signals into completed outcomes without adding headcount.

What should you ask vendors tomorrow?

If you do not have a dedicated admin, prioritize platforms with prebuilt connectors and role-based automation so onboarding does not require a six-person rollout team. If compliance is a constraint, insist on SOC 2 and GDPR controls, and explicit guarantees regarding data use. If speed matters, test the end-to-end time it takes to run a familiar multi-step playbook, not just API uptime. These queries separate configuration projects from tools that actually reduce work.

It is exhausting when a platform meant to simplify your day ends up making every task take longer; that frustration is why teams leave and why they expect something that simply remembers context and finishes work for them. There is a deeper twist to this story, and the next section will make you rethink which tradeoffs you can actually afford.

11 Best Gainsight Alternatives For Customer Success Teams

These eleven options offer clear trade-offs: some replace heavyweight admin work with lightweight automation, others plug into existing revenue systems, and one class of tools actually executes work across apps rather than only surfacing signals. Pick two questions: how much admin bandwidth you have, and whether you need a platform that completes multi‑step work for you rather than asking you to stitch context together.

1. Coworker AI

Coworker AI is an advanced enterprise AI agent platform that functions as a virtual colleague, leveraging proprietary organizational memory to handle complex tasks in customer success operations. Unlike traditional platforms that often struggle with data silos and manual processes, it synthesizes information from multiple sources, anticipates risks, and executes proactive strategies across integrated tools. This innovative approach positions it as a forward-thinking alternative to Gainsight, delivering rapid insights and automations that enable teams to scale retention efforts efficiently while reducing time spent on routine synthesis.

Key Features for Customer Success Teams

Dynamic customer health scoring that pulls from all touchpoints, including usage data, support interactions, and communication sentiment for real-time assessments.

Proactive intervention alerts that flag emerging risks and suggest timely actions before issues escalate.

Automated onboarding documentation and handover creation by compiling details from meetings, tickets, and historical records.

Feedback aggregation and analysis across channels to uncover product insights and sentiment trends.

Multi-step playbook execution, such as drafting personalized outreach, updating CRM records, or routing tasks autonomously.

Meeting intelligence with summaries, action item tracking, and follow-up automation from call transcripts.

Predictive expansion recommendations based on behavioral patterns and organizational benchmarks.

Cross-functional synthesis connecting customer data with sales, product, and support contexts.

Pros

Delivers 8-10 hours of weekly time savings per user through reduced manual information gathering and task handling.

Provides enterprise-grade security with SOC 2 Type 2 certification, GDPR compliance, and strict permission controls.

Enables rapid deployment in 2-3 days, avoiding the lengthy setup process common in legacy systems.

Offers transparent per-user pricing without hidden fees, making it cost-effective for scaling teams.

Excels in cross-tool execution across 25+ applications, eliminating silos and enabling smooth workflows.

Supplies proactive, context-aware insights that anticipate needs rather than reacting to them.

Achieves high accuracy in churn prediction and opportunity detection via deep organizational understanding.

Best Use Cases

Monitoring customer health and flagging risks early through multi-channel signal analysis.

Automating onboarding processes with customized documentation and guided journeys.

Aggregating and synthesizing feedback from diverse sources for actionable product improvements.

Accelerating interventions with automated alerts and personalized engagement sequences.

Preparing for reviews or renewals with comprehensive briefings from historical data.

Identifying upsell opportunities by correlating usage trends with success patterns.

Streamlining meeting follow-ups and action tracking across customer interactions.

Enabling proactive retention strategies in fast-growing SaaS environments.

Best For

Mid-to-large enterprises seeking to augment customer success teams with AI without adding headcount.

Organizations are frustrated with fragmented data and reactive tools needing unified, proactive management.

Teams prioritizing quick value realization and minimal implementation disruption.

Companies handling complex customer relationships require deep context and cross-departmental alignment.

Budget-conscious leaders want powerful capabilities at predictable, scalable costs.

Growing SaaS businesses aiming to reduce churn and boost expansions through intelligent automation.

2. Velaris

Velaris is a versatile customer success system that provides comprehensive oversight of client interactions, processes, and team efficiency, making it an excellent choice for businesses looking to streamline their post-sales efforts. It excels at adapting to specific operational styles and delivering top-tier support, with expert staff managing technical aspects and connections so internal resources can stay focused on core tasks. Users appreciate its rapid rollout and customization, which address Gainsight's often-cited steep curve and administrative demands.

Key Features

Consolidated information and clear views: Brings together dispersed details into a central hub, supporting multi-level structures from individual profiles to broader entities, with aggregated wellness indicators.

Tracking vital indicators: Monitors metrics such as application activity, satisfaction ratings, and issue counts, then combines them into customizable formulas to forecast losses and drive add-on sales.

Tools for automated paths and virtual interactions: Features an intuitive pull-and-place system for designing client progressions, enabling scripted messages, guided introductions, upselling paths, and routine input automations.

Adaptable analytics for various needs: Allows creation of panels to examine diverse metrics, from future renewals to usage patterns, add-on trends, or overlooked groups.

Intelligent data examination: Uses artificial tech to evaluate client emotions, review exchanges, spot emerging patterns, and offer practical forecasts for forward-thinking management.

3. Planhat

Planhat acts as a unified customer success framework that integrates revenue generation, post-sales support, and service delivery into a cohesive environment. It provides resources to manage client relationships, monitor key metrics, and enhance loyalty. Although it allows for adaptability across departments, it may fall short for groups that rely heavily on sophisticated scripting or detailed strategy mapping, positioning it as a balanced choice compared with Gainsight's heavier build.

Key Features

Integrated processes: Merges income, support, and service functions into one setup to aid interdisciplinary groups.

Diverse capabilities: Broad functionality enables effective management of diverse activities in a single space.

Ready-made scripting models: Supplies prepared automation frameworks drawn from sector standards to normalize operations and conserve effort.

Fundamental connections: Links with key applications to unify client information and optimize activities.

Cross-team alignment: Facilitates collaboration across functions, though with constraints on tailoring data layouts to meet complex requirements.

4. ChurnZero

ChurnZero focuses on a customer success setup designed to identify and reduce departure risk efficiently. It provides an extensive set of tools to boost engagement, assess client engagement, and script routines. While it excels in loss prevention, some organizations report that its navigation and initial configuration are less straightforward than peers', making it a targeted alternative to Gainsight's broader but sometimes sluggish analytics.

Key Features

Emphasis on loss control: Tailored to pinpoint vulnerable profiles and implement preventive measures for keeping clients.

Interaction resources: Includes embedded notifications and messaging options to maintain active connections across the client cycle.

Data examination and summaries: Provide in-depth evaluations and vitality ratings to reveal client behavior and engagement shifts.

Linkages: Connects with numerous applications for improved oversight and information merging.

Alert systems: Provide notifications for risks, though there may be setup challenges with advanced hierarchies.

5. Vitally

Vitally presents a customer success framework that emphasizes ease and speed, with a straightforward layout and essential tools to monitor client health and refine processes. Its limitations in personalization and advanced options may not align with expanding or large-scale entities, offering a lighter approach compared to Gainsight's resource-heavy structure.

Key Features

Accessible design: Praised for its simple navigation, aiding quick uptake by groups.

Tailorable vitality assessments: Enable rating definitions using personalized measures for precise client status assessment.

Shared work areas: Dedicated instruments like joint documents to synchronize support staff and clients during key stages like introductions and evaluations.

Income monitoring: Strong resources for tracking repeating earnings, departures, and fiscal indicators to gauge achievements and spot advancements.

Onboarding aids: Supports smooth starts, though with a minor adjustment period for configuration.

6. Totango

Totango provides a comprehensive customer success system with a range of tools to manage customer relationships, drive loyalty, and drive growth. Its emphasis on vitality tracking, process scripting, and output monitoring renders it a solid selection for scaling operations. Nevertheless, some firms struggle with rollout and ease, especially for complex processes or linkages, which counter Gainsight's enterprise demands.

Key Features

Complete tool collection: Includes resources for vitality oversight, routine scripting, and strategy development to ensure comprehensive post-sales control.

Growth potential: Assists expanding teams with adaptable modules to start small and scale as needed.

Vitality evaluation: Provides transparent overviews of client conditions to prioritize risks and opportunities.

Connections: Joins with several applications to centralize information and boost interdisciplinary teamwork.

Renewal handling: Aids in managing continuations, though implementation can demand substantial time.

7. HubSpot

HubSpot is a comprehensive CRM system primarily designed for revenue and promotional activities. Still, it has expanded to include post-sales tools, positioning it as a cost-effective, straightforward option for extending existing setups into client management. It seamlessly integrates with revenue data to enable smooth transitions between departments, featuring an easy-to-navigate layout and upcoming key performance indicators. This makes it a practical entry-level option compared with Gainsight's more specialized, intricate structure, especially for groups already invested in its ecosystem.

Key Features

Budget-conscious selection: Delivers accessible rates, ideal for emerging operations or those initiating post-sales efforts.

Revenue information linkage: Naturally bridges client management with revenue records, simplifying departmental handovers.

Straightforward operation: Boasts a user-friendly setup, with emerging vitality assessments to support basic monitoring.

Self-service summaries: Enable the simple creation of insights for rapid overviews without extra assistance.

Built-in promotional resources: Combines email campaigns and tracking for unified client outreach.

8. Custify

Custify delivers a straightforward customer success solution emphasizing essential vitality tracking, automation, and insights tailored for mid-market SaaS firms seeking clean, efficient operations. It prioritizes quick deployment and low overhead, avoiding the bloat often associated with larger platforms. Users value its focused approach to core retention drivers, making it a leaner alternative to Gainsight's expansive feature set.

Key Features

Vitality assessments: Customizable scores based on usage, feedback, and behavioral signals to flag risks early.

Workflow scripting: Pre-built and adjustable automations for onboarding, renewals, and engagement touches.

Client portal options: Shared spaces for collaboration, though simpler than dedicated community tools.

Data unification: Pulls from CRMs and other sources for centralized views without heavy configuration.

Affordable scaling: Transparent tiers that grow with customer volume, suitable for budget-aware teams.

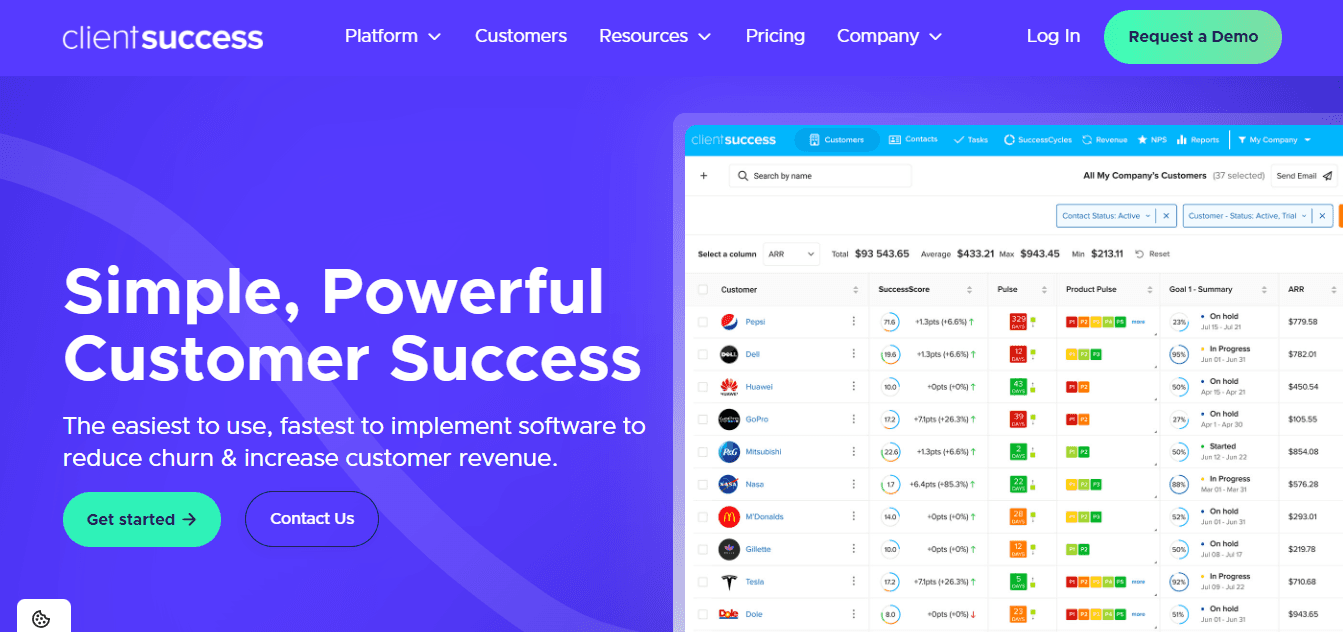

9. ClientSuccess

ClientSuccess provides a dedicated platform for managing client relationships with a strong emphasis on pulse checks, success planning, and executive reporting. It appeals to teams wanting proven methodologies without excessive customization overhead. Reviews highlight its reliability for mid-sized operations focused on retention metrics, offering a more streamlined path than Gainsight's enterprise depth.

Key Features

Pulse monitoring: Regular check-ins and sentiment tracking to maintain relationship health.

Success blueprints: Structured templates for onboarding and ongoing value delivery.

Executive dashboards: High-level views of portfolio performance and renewal forecasts.

Task management: Automated reminders and assignments to keep teams aligned.

Integration support: Connects to common CRMs to enable data flow and context.

10. Catalyst

Catalyst offers a modern customer success tool centered on automation, collaboration, and revenue alignment for growing SaaS businesses. It stands out with template-driven workflows and community features, enabling faster value realization. Many users note its balance of power and simplicity, making it a more agile option than Gainsight's heavier administration.

Key Features

Template workflows: Ready-to-use playbooks for common scenarios like expansions and renewals.

Team collaboration: Shared notes and internal alignment tools for cross-functional work.

Community building: Built-in forums to foster user engagement and advocacy.

Revenue insights: Tracking of expansion potential and churn indicators.

Quick onboarding: Designed for rapid setup and immediate productivity gains.

11. SmartKarrot

SmartKarrot supplies an intelligent customer success system with advanced predictive capabilities, workflow orchestration, and personalized engagements for subscription-focused companies. It differentiates through AI-enhanced churn prevention and growth recommendations, serving teams that need data-backed proactivity. As a scalable yet accessible choice, it counters Gainsight's complexity with focused intelligence.

Key Features

Predictive analytics: Forecasts churn and expansions using historical patterns and current behaviors.

Personalized journeys: Tailor interactions to individual account needs and milestones.

Workflow orchestration: Automates multi-touch sequences across channels.

Portfolio management: Tools for segmenting and prioritizing high-value accounts.

Cross-team visibility: Dashboards uniting success, support, and product data.

Most teams find that platforms that both remember context and complete tasks compress weeks of coordination into hours. Still, that shift requires accepting a new operating model in which the platform operates as a teammate, not just reports to a scoreboard. That choice feels decisive now, but what you should actually evaluate next will surprise you.

Features to Consider When Choosing a Gainsight Alternative

Pick features that change day-to-day behavior, not just the ingredient list on a spec sheet. First look at cost and usability, then at implementation speed, API maturity, vendor support, and compliance; these factors determine whether a new platform becomes a working tool or another archive of half-finished rules.

How will this affect our budget and renewals?

Pricing models matter more than headline SKU names. Ask for line-item examples that show connector fees, ingestion tiers, and professional services across a realistic growth curve, then stress-test those numbers against expected account volume for three renewal cycles. Pricing is a dealbreaker for many teams, according to the Churn Assassin Blog, 2025 — "70% of teams reported that Gainsight's pricing was too high for their budget", so insist on scenario pricing before you sign anything.

Will people actually use this every day?

Evaluate the interface with real users, not admins. Run a five-day usability trial where CSMs do everyday tasks without a product expert at their elbow, and measure time to complete each task and error rates. This matters because setup fatigue is common across small product-led teams and mid-market CS groups, where complex tools often force a single admin to become a gatekeeper. Usability fails quietly but destructively, and the cost shows up as stalled adoption and manual workarounds, which is why Churn Assassin Blog, 2025 — "60% of users found Gainsight's interface to be overly complex and difficult to navigate" should change how you weight UX in procurement.

How fast will we see real results?

Time to value is not marketing; it is a deadline you can test. Require a 30-day proof of value that executes a representative multi-step playbook end-to-end, from signal detection to task assignment and follow-up, and measure playbook completion rate, number of manual escalations, and time from detection to remediation. If a vendor cannot deliver a working demo in that window, you will be buying configuration effort, not capability.

What support and implementation model does the vendor commit to?

Compare support tiers as if they were service contracts. Inspect whether onboarding includes a named success engineer, prebuilt playbooks, and a documented rollback path for connector changes. White-glove onboarding matters when internal CS ops headcount is low; a vendor that treats implementation like a project, with milestones and knowledge transfer, reduces your governance risk.

Most teams handle onboarding and maintenance with heavy admin effort because that approach is familiar and keeps control in-house. That works until churn-inducing outages or schema changes surface at scale. Then the hidden cost appears: weeks of reconciling scores, stalled renewals, and a single person who knows how everything hangs together. Solutions like enterprise AI agents offer a different path, centralizing connector maintenance, automating recurring cleanups, and preserving audit trails so routine upkeep does not consume your CS ops bandwidth.

Can engineers extend the system without breaking it?

Check API surface and developer ergonomics. You want stable webhooks, SDKs, schema versioning, and a sandbox that mirrors production. Ask for a documented migration path for custom fields and a changelog that is machine-readable, because brittle integrations are what turn a flexible platform into a fragile one.

Are auditability and data residency baked in?

Demand exportable audit logs, field-level access controls, and explicit policies for data retention and deletion. Verify encryption at rest and in transit, and obtain a clear statement on whether customer data will be used to train vendor models. These items belong in the contract, not the trust conversation.

What metrics will prove the platform works?

Put complex success criteria in the SOW: time to first automated remediation, reduction in weekly admin hours, playbook completion percentage, data freshness lag, and the percentage of alerts that require human escalation. For each metric, set a baseline during your POC, then need a roadmap for how the vendor will reach target improvements within 90 days.

Choosing a platform is like picking tools for a workshop: you can buy a precision bench tool that demands calibration and a specialist operator, or you can select a reliable set that a whole team can use without constant babysitting; match the tool to the number of hands you have and the cadence you need. That pattern of choices and tradeoffs is where procurement conversations derailed more often than you'd expect, and that’s what we'll unpack next.

Related Reading

How to Choose the Right Gainsight Alternative For Your Team

Start by aligning your purchase criteria with concrete, testable outcomes: reduce daily context switching, shorten the time from signal to action, and cap total first‑year cost, including implementation. Then pick the vendor that demonstrates those outcomes in a short, realistic pilot rather than promising them on a roadmap.

Define Your Team's Needs and Challenges

Start by thoroughly mapping your current customer success processes and identifying gaps, such as inefficient data handling or reactive issue resolution, that prompted the search for alternatives. Consider factors such as your company's size, the number of customer success managers, and specific pain points, including budget constraints or the absence of dedicated technical support. This step is crucial because Gainsight's enterprise-level design is often well-suited to large organizations with robust resources. Still, it can overwhelm smaller teams lacking admins for ongoing maintenance, leading to underutilized features and frustration.

In-depth evaluation here involves listing key performance indicators for retention, engagement, and growth, then prioritizing must-have capabilities such as automated alerts and health metrics. Teams should assess if they need a full-featured platform or a lighter tool focused on core tasks, ensuring the alternative addresses scalability without introducing new complexities that mirror Gainsight's steep curve.

Compare Essential Features and Tools

Examine the core capabilities of potential platforms, focusing on areas such as workflow automation, predictive analytics for risk, and customizable dashboards for insights. This is vital, as Gainsight's comprehensive but cumbersome tools may not provide the agility needed in dynamic environments, prompting consideration of alternatives with streamlined automations and intuitive interfaces. Competitors emphasize selecting systems that offer robust health scoring, journey mapping, and engagement tracking without requiring extensive configurations.

Explore deeper by matching features to your workflows, such as real-time data processing to avoid Gainsight's reported lags with large volumes. Prioritize AI-driven elements for proactive interventions, ensuring the chosen tool enhances efficiency in spotting upsell chances or mitigating churn, ultimately fostering a more responsive customer success strategy.

Evaluate Integration and Compatibility Options

Review how well the alternative integrates with your existing tech stack, including CRMs such as Salesforce or HubSpot, communication apps, and analytics tools. Smooth integrations are essential to prevent data silos and enable a unified customer view, while addressing Gainsight's reliance on specific configurations that can complicate adoption across diverse systems. This criterion helps maintain operational flow and reduces time spent on manual data transfers.

In greater detail, test for broad connector availability—aim for platforms that support 20-30 apps and handle both structured and unstructured inputs effectively. Based on research comparisons, opt for solutions with flexible APIs and prebuilt links, such as Coworker, that minimize engineering involvement, counter Gainsight's integration hurdles, and enable faster, more reliable data synchronization across your ecosystem.

Analyze Pricing Models and Overall Expenses

Scrutinize cost structures, including base fees, per-user charges, and add-ons for features, while calculating the total first-year outlay encompassing implementation and training. Transparency in pricing is essential, as Gainsight's quote-based approach often results in unexpectedly high bills, making it unsuitable for budget-conscious teams. This analysis ensures alignment with financial goals and avoids overpayment for unused capabilities.

Explore further by comparing annual versus monthly contracts and scalability tiers that grow with your business. Go for fixed- or usage-based models starting at under $500 per month, which provide all core tools without tier restrictions and offer better value than Gainsight's enterprise pricing, which requires a significant upfront investment.

Assess Setup Time and User-Friendliness

Consider deployment duration and learning requirements, aiming for platforms with rapid onboarding—ideally within weeks rather than months—to deliver quick wins. Ease of use is critical, as Gainsight's interface and administrative requirements can reduce productivity, especially for non-technical users. This factor directly impacts adoption rates and team satisfaction, ensuring the tool becomes an asset rather than a hindrance.

Dive into specifics by checking for no-code customizations, guided setups, and minimal maintenance demands. Competitor recommendations stress selecting intuitive designs with responsive support during rollout, overcoming Gainsight's lengthy implementations by enabling self-service configurations that allow teams to launch effectively without external consultants.

Investigate Support Services and Community Backing

Assess the quality of vendor support, including dedicated managers, knowledge bases, and response times for queries. Strong support is indispensable for resolving issues swiftly, in contrast to Gainsight's sometimes-criticized slow resolution times, which can disrupt operations. This element builds confidence in the platform's reliability, particularly during initial phases or scaling. In more depth, evaluate community resources like forums or user groups for peer insights, alongside training options such as webinars. Based on industry overviews, prioritize providers that offer proactive guidance and unlimited support across plans to address Gainsight's limitations, fostering a supportive ecosystem that accelerates problem-solving and maximizes tool utilization.

Review Feedback and Perform Practical Tests

Consult independent reviews on sites like Gartner or G2, focusing on verified user experiences regarding performance, reliability, and ROI. This step uncovers real-world strengths and weaknesses, helping to avoid alternatives that replicate Gainsight's issues, such as performance slowdowns. Balanced feedback ensures an informed choice grounded in collective user data. Extend this by arranging demos or free trials to simulate your workflows and involve your team in hands-on evaluation. Research recommendations include testing key scenarios, such as data imports or report generation, to confirm the platform's fit and its potential to improve customer outcomes beyond what Gainsight provides.

One practical checklist to use during vendor selection

Require a 30‑day, working POC that runs a real multi‑step playbook end-to-end.

Insist on scenario pricing for three growth cases and a cap on professional services.

Validate prebuilt connectors and a public changelog for schema updates.

Deploy a five‑day usability trial with line CSMs, not admins.

Put three SOVs in the contract with remediation timelines.

That’s actionable, practical work you can run this quarter, and it changes the decision from vendor promises to verifiable results. The decision you make now will reveal whether your next tool becomes a teammate or another spreadsheet-vitamin; the next choice is where the real proof arrives.

Related Reading

Sierra Alternatives

Freshworks Alternatives

Catalyst Vs Gainsight

Totango Competitors

Book a Free 30-Minute Deep Work Demo

Most teams search for Gainsight alternatives because they need work to be completed, not just another place to store context. If faster loop closure and fewer manual handoffs matter, see a live example. Schedule a short deep work demo, and we will run a representative multi‑step playbook on your stack so you can judge whether Coworker’s execution-first approach fits your CS playbook.

Do more with Coworker.

Coworker

Make work matter.

Coworker is a trademark of Village Platforms, Inc

SOC 2 Type 2

GDPR Compliant

CASA Tier 2 Verified

Links

Company

2261 Market St, 4903 San Francisco, CA 94114

Alternatives

Do more with Coworker.

Coworker

Make work matter.

Coworker is a trademark of Village Platforms, Inc

SOC 2 Type 2

GDPR Compliant

CASA Tier 2 Verified

Links

Company

2261 Market St, 4903 San Francisco, CA 94114

Alternatives

Do more with Coworker.

Coworker

Make work matter.

Coworker is a trademark of Village Platforms, Inc

SOC 2 Type 2

GDPR Compliant

CASA Tier 2 Verified

Links

Company

2261 Market St, 4903 San Francisco, CA 94114

Alternatives