21 Best Enterprise Customer Data Platforms in 2026

Jan 5, 2026

Dhruv Kapadia

Consider your support, marketing, and sales teams chasing different versions of the same customer across CRM records, product events, email history, and ad platforms, so personalization feels like guesswork. Enterprise customer data platforms sit at the center of AI Tools For Customer Success, integrating identity resolution, unified customer profiles, segmentation, real-time analytics, predictive models, and privacy controls to enable a consistent view. Want to stop losing revenue to scattered data and start improving retention with consistent customer journeys?

This guide shows how to confidently select and implement the top enterprise CDP for 2026 to unify customer data, eliminate silos, and unlock personalized experiences that skyrocket revenue and retention. To make that practical, Coworker's enterprise AI agents act like hands-on advisors that map your data sources, recommend the right CDP for your identity graph and compliance needs, and guide your team through integrations, governance, and activation so you move faster from plan to measurable revenue and retention gains.

Summary

By 2025, 80% of enterprises will have adopted a customer data platform, signaling that CDPs are moving from optional tools to core infrastructure for unified customer context.

Customer data platforms can increase marketing efficiency by 30%, and enterprises using CDPs report roughly a 30% lift in customer engagement, showing measurable returns on targeted personalization.

Platforms that optimize pipelines and identity matching can shrink end-to-end data processing time by up to 50%, which matters when decisions depend on streaming product events and low-latency signals.

Governance is not optional, since 60% of businesses achieve a return on investment within the first year of CDP adoption, making consent enforcement, role-based access, and audit trails essential to preserve speed-to-value.

Run a focused pilot of four to eight weeks that instruments three metrics, because 75% of enterprises report that CDPs improved their data-driven marketing campaigns when pilots prove real-world outcomes.

Operational discipline matters: in one mid-market team, data prep and reconciliation consumed roughly half their day, and integration breadth commonly requires connectors to 40+ apps to avoid manual stitching.

This is where Coworker's enterprise AI agents fit in, mapping data sources, recommending the right CDP for identity and compliance needs, and guiding teams through integrations, governance, and activation.

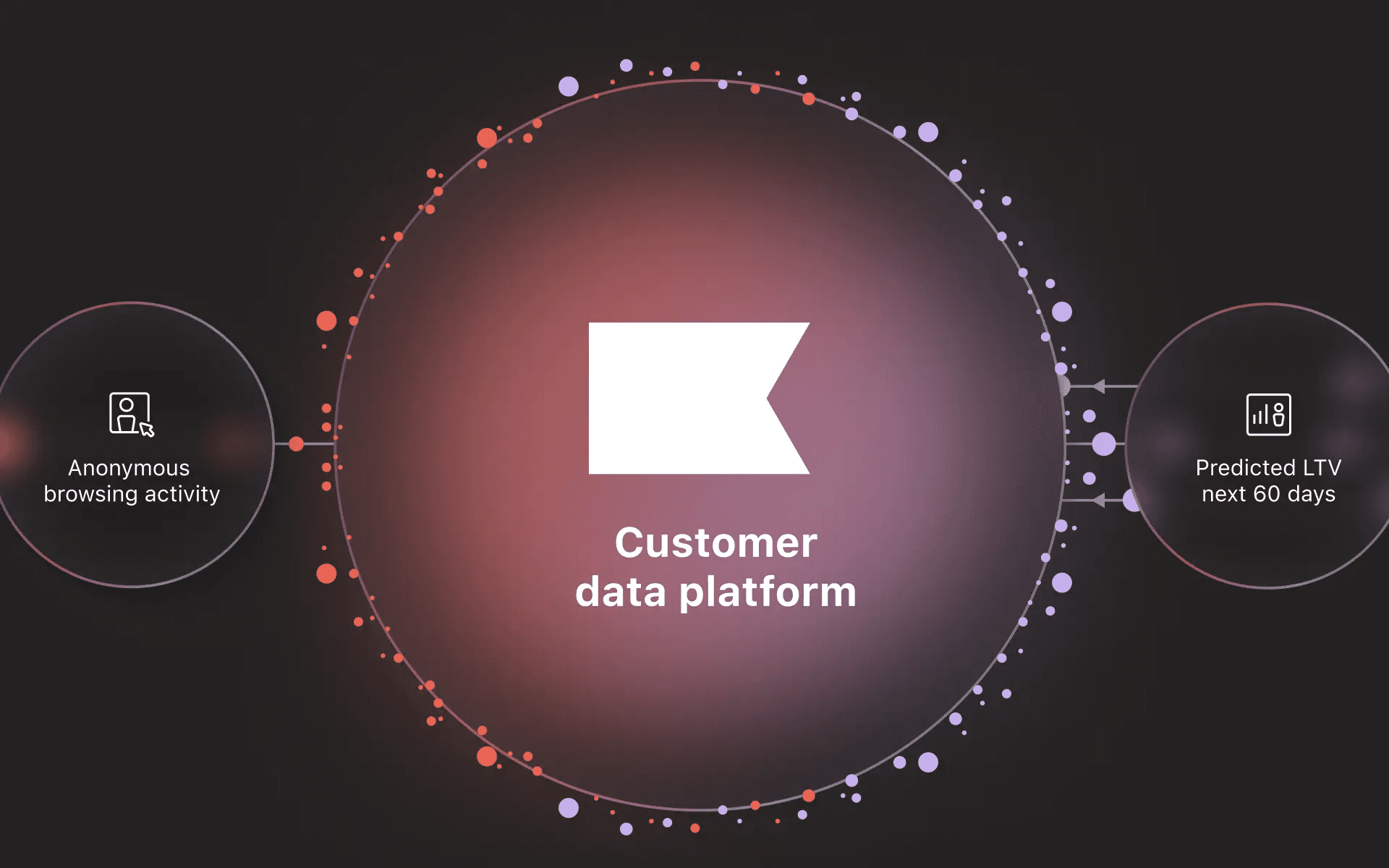

What are Enterprise Customer Data Platforms, and How Do They Work?

Enterprise customer data platforms power action, not just reports: they hold a trusted, queryable memory that downstream systems and people can use to make decisions and take work off your team’s plate. They do this by exposing consistent profiles, live signals, and executable outputs so automation, analytics, and frontline teams operate from the same authoritative context.

How do they keep context soft and valuable, rather than brittle?

They rely on an active memory layer that keeps facts up to date, links identities across systems, and stores derived features for fast computation. In practice, that means a mix of streaming ingestion, normalized schemas, graph stores for relationships, and semantic embeddings that enable search and reasoning against customer history as if it were a single, unified file. It is like an operating-room whiteboard that automatically updates with lab results, notes, and next steps, so the team never repeats handoffs or loses the thread.

What breaks when teams operate without an operational CDP?

Most teams stitch data with spreadsheets, nightly exports, or point-to-point middleware because those approaches are familiar and quick to start. That familiarity hides costs: alerts arrive late, reps work with stale context, and cross-team work stalls while files sync. Platforms like Coworker change that by connecting across 40+ apps, reasoning from combined customer and internal signals using an OM1 memory architecture, and executing multi-step workflows such as pre-populating support tickets or initiating retention playbooks, reducing manual coordination and shortening cycle times.

How does this translate into measurable business value?

Adoption is accelerating with Zeta Global. By 2025, 80% of enterprises will have adopted a customer data platform, indicating CDPs are becoming standard infrastructure rather than optional tooling. And the payoff shows up in day-to-day operations: Zeta Global, a Customer Data Platform, Reports That Customer data platforms can increase marketing efficiency by 30% in 2025, meaning teams can run smarter segments and reduce wasted spend while preserving privacy and consent controls. That looks like earlier churn detection, automated handoffs that eliminate repetitive tasks, and product teams shipping features faster because they trust the customer signals that drive decisions.

What operational safeguards protect this work enterprise?

You need consent enforcement, role-based access, strong audit trails, and a guarantee that your training pipelines never ingest raw customer content. Good platforms implement policy gates at the connector layer, log every model decision, and separate model weights from underlying enterprise data so compliance teams can audit without exposing sensitive records. That keeps the system actionable and accountable at scale. An analogy to keep you honest: raw data is coal, profiles are bricks, but an operational CDP is the foundry that shapes those bricks into machinery that actually moves work forward — and if you skip the foundry, you end up hauling coal with a wheelbarrow. That capability feels like a breakthrough, but the one operational trap most teams never plan for changes everything.

Related Reading

How Can You Use an Enterprise Customer Data Platform?

Use an enterprise CDP to move decisions and actions out of spreadsheets and into repeatable, measurable playbooks that actually run the business. Focus each rollout on one high-value use case, instrument outcomes, then expand the system as wins compound.

Which data sources matter first?

Start with sources that change decisions this week, not the ones that look impressive on a roadmap. Prioritize CRM records, transaction systems, product usage events, and support logs because they quickly impact revenue and retention. Catalog each source, assign an owner, and create a simple ingestion SLA so teams know when data is reliable enough to drive automation, not just dashboards. Adoption is widespread; treat this as pragmatic triage rather than an optional project. According to GrowthLoop Blog (2023), over 70% of enterprises have adopted a customer data platform to enhance their marketing strategies.

How do you turn profiles into repeatable work?

Think in terms of playbooks: modular sequences that move a customer from signal to action. Design a churn playbook that watches a small set of features, scores risk, notifies an assigned rep, and opens a timed retention flow if outreach fails. Build these playbooks as composable blocks so a single condition can trigger email, task creation, and an internal Slack update with a canned summary. This keeps execution consistent and auditable while letting you iterate on the parts that drive outcomes.

Most teams coordinate these flows with ad hoc scripts and manual handoffs, because that feels fast at first. That familiarity hides real costs: missed signals, duplicated work, and stalled follow-ups that erode confidence. Platforms like enterprise AI agents change that pattern by linking customer state across tools, reasoning about next steps, and executing multi-step work across apps, compressing follow-ups from days to hours while preserving full audit trails.

How should we measure success?

Define three metrics before you flip any switches: a behavioral activation tied to your use case, a conversion or retention outcome downstream, and an operational metric such as time-to-resolution or handoff latency. Track both lift and velocity, because a 5 percent conversion lift with a 60 percent faster cycle time compounds better than a one-off high lift that is expensive to sustain. And expect to see clear engagement wins when the system is executed properly, as GrowthLoop Blog (2023) reports that enterprises using customer data platforms have seen a 30% increase in customer engagement.

What operational practices prevent failure?

This pattern appears across marketing and support teams: fragmented sources plus vague goals equals stalled rollouts. Avoid that by enforcing three practical rules. First, run a timeboxed pilot, 6 to 8 weeks, limited to a single channel and cohort. Second, require data contracts and a schema registry so that consuming teams never have to guess the meaning of fields. Third, add observability to pipelines with alert thresholds for latency, schema drift, and match rate. Those rules stop minor problems from becoming system-wide failures.

How does governance stay usable, not bureaucratic?

Make governance a guardrail, not a roadblock. Use role-based entitlements and attribute-level masking for day-to-day access, along with a straightforward consent token workflow that links downstream actions to explicit permissions. Keep retention policies automated by tagging records with TTLs and enforcing deletion or anonymization as a background job. Finally, route any model-training request through a policy gate that blocks raw customer content from leaving production unless a compliance review clears it.

What about developer and data-team practices?

Treat the CDP like a product. Ship small, instrument everything, and version transformations. Use feature stores for computed signals with clear ownership and SLAs, and include replay tests to validate changes against historical outcomes before they go into production. Think of it like continuous delivery for customer context, where each deployment has a rollback plan and a real-world metric attached. A short analogy to make this concrete: running a CDP without these habits is like hiring an orchestra but letting every musician choose their own sheet music, then wondering why the performance sounds chaotic.

What most teams underestimate is how social the work is—you will need change management, clear SLAs, and a scoreboard that makes nontechnical stakeholders pay attention. That effort buys you consistency and the confidence to automate more over time. That pattern is useful, but what actually separates the handful of CDPs that deliver measurable impact from the rest is still quietly surprising.

21 Best Enterprise Customer Data Platforms

These 21 platforms fall into four practical buckets: action-first AI agents, activation-focused marketing CDPs, warehouse-first analytics stacks, and verticalized experience platforms. Pick the problem you need to solve first, then match integration surface, execution capability, and governance to that problem.

1. Coworker

Coworker redefines enterprise data management as a pioneering AI agent with OM1 Organizational Memory, serving as an intelligent teammate that understands company context, executes multi-step tasks, and integrates across 25+ applications. Unlike basic assistants, it delivers perfect recall of teams, projects, customers, and processes, slashing information search time by 60% and boosting productivity 14% for sales, engineering, and SEO teams handling complex customer data workflows.

Key Features

OM1 memory architecture tracks 120+ parameters to provide cross-functional insights and the temporal evolution of decisions.

Three modes—Search for contextual retrieval, Deep Work for analysis and execution, Chat for real-time internal/external toggling.

Sales use cases like pipeline intelligence, customer health scoring, and pre-call briefings from CRM and transcripts.

Engineering tools for automated docs, codebase onboarding, Jira automation, and feedback-driven product gaps.

Enterprise security with SOC 2 Type 2, GDPR compliance, and permission-respecting integrations deployed in 2-3 days.

Perfect organizational recall provides instant access to customer knowledge from teams, projects, and historical interactions.

Cross-functional synthesis connects customer insights across sales, success, engineering, and SEO departments over time.

Context-aware assistance tailors responses to user roles, priorities, and ongoing customer projects.

Temporal understanding tracks customer decision evolution, feedback trends, and relationship changes.

Proactive insights surface customer issues, health scores, and opportunities before escalation.

Multi-step execution handles complex customer data tasks like analysis, documentation, and workflow automation.

25+ enterprise app integrations unify customer data from CRM, support tickets, and meeting transcripts.

Three modes: Customer profile search, Deep Work for journey analysis, and Chat for real-time queries.

Relationship intelligence maps customer connections to people, projects, and problems.

SOC 2 Type II and GDPR compliance ensure secure handling of customer data through robust permission controls.

Pros of Coworker as a CDP Solution

Coworker outperforms traditional CDPs by functioning as an active AI teammate rather than passive storage.

Reduces information synthesis time by 60%, freeing teams to focus on high-value customer work.

Delivers 14% productivity velocity gains through automated customer insights and execution.

Cross-platform intelligence spans departments, unlike siloed enterprise AI tools.

Rapid 2-3 day deployment vs. weeks of complex CDP setups.

Transparent per-user/month pricing at 0.5x the cost of competitors like Glean.

Eliminates development costs with out-of-the-box OM1 vs. DIY solutions.

Respects existing permissions without elevation risks.

Scales from 100 to 10,000+ employees handling enterprise customer volumes.

Action-taking capabilities beyond search, including task execution across apps.

Comprehensive ROI with 8-10 hours of weekly time savings per user.

Best Use Cases for Customer Data in Coworker

Coworker excels at customer-centric workflows, leveraging unified data to drive proactive engagement.

Sales & Customer Success

Sales pipeline intelligence analyzes CRM data, transcripts, and deals to accelerate deal acceleration.

Customer onboarding generates handover docs from all touchpoints.

Meeting intelligence summarizes calls with action items and follow-ups.

Customer feedback aggregates channels for product insights.

Competitive intelligence updates battle cards from mentions.

Customer health scoring enables proactive interventions.

Sales content personalizes materials from memory.

Pre-call research compiles briefings from past interactions.

Product/Engineering

Customer feedback analysis identifies product gaps from calls and tickets.

Cross-team deflection translates customer issues to technical terms.

SEO Agencies

Client intelligence tracks relationships, project history, and metrics.

Campaign context monitors performance and strategic decisions.

Team coordination maps who handled client work and timelines.

Proactive account management surfaces issues and opportunities.

Cross-client learning applies strategies across portfolios.

Content strategy generates data-driven recommendations.

Best For

Augmenting sales teams with real-time customer profile synthesis.

Accelerating customer success through health scoring and interventions.

SEO firms managing multi-client campaign memory and insights.

Engineering teams are closing feedback loops from customer interactions.

Departments are wasting time on data synthesis (50% daily loss).

Organizations with siloed AI lack cross-functional customer views.

Rapid deployment needs (2-3 days) with enterprise security.

Cost-conscious scaling vs. expensive search or custom builds.

Complex work execution, like multi-step customer journey orchestration.

Solution-aware buyers are frustrated by generic AI assistants.

2. Quickbase

Quickbase is a leading no-code customer data platform that enables enterprises to build bespoke applications to streamline sales operations and foster team synergy through real-time data visibility. It allows non-technical users to integrate information from diverse sources, boosting operational agility and supporting data-driven expansion strategies.

Key Features

Automated email alerts keep teams notified of key updates without manual checks.

An extensive RESTful API collection enables smooth automation and system linkages.

More than 40 native connectors integrate seamlessly with tools such as Salesforce and Slack.

Dedicated mobile app provides anytime, anywhere access to apps and workflows.

A visual drag-and-drop builder simplifies the creation of custom apps and processes.

3. Klaviyo

Klaviyo excels as a customer data platform tailored for ecommerce, pulling together information from multiple channels to deliver a complete customer profile. It supports marketing and support teams with a user-friendly setup, sophisticated analytics, and AI enhancements to personalize outreach and refine campaigns swiftly.

Key Features

AI-powered predictions forecast metrics like lifetime value and churn probability.

Trigger-based automation handles emails, texts, and notifications for timely engagement.

Versatile web forms capture leads and expand audiences smoothly.

RFM tools evaluate customers by recency, frequency, and spending patterns.

Advanced segmentation targets precise groups across email, SMS, and apps.

4. Velaris

Velaris provides a unified hub for customer information, emphasizing health metrics and sentiment analysis to guide engagement strategies. It integrates seamlessly into sales, marketing, and success workflows, using predictions to identify churn risk and unlock growth potential through automated responses.

Key Features

Comprehensive account summaries highlight risks and opportunities for engagement.

Flexible health scoring customizes metrics for accurate churn forecasting.

The custom report builder generates shareable insights from diverse data.

Instant notifications alert teams to health shifts for quick action.

Multi-level monitoring provides both broad and detailed views of customers.

5. Bloomreach

Bloomreach combines customer data platform capabilities with content and search tools, making it ideal for retail and online stores seeking personalized experiences. It leverages real-time data and AI to craft targeted campaigns, overcoming data fragmentation for higher engagement and sales.

Key Features

Dynamic segmentation builds groups from real-time interactions to enable precise targeting.

AI-enhanced automation runs intricate campaigns, such as email journeys.

Tailored product suggestions boost shopping based on user history.

Privacy controls manage consents to ensure compliance and trust.

Real-time analytics track behaviors to enable immediate strategy adjustments.

6. Medallia

Medallia transforms customer input into actionable insights through AI analytics across industries such as retail and health services. It deploys multi-channel surveys and sentiment tools to enhance experiences, automate data collection, and pinpoint issues for proactive improvements.

Key Features

Intelligent contact hubs use AI to predict trends and improve interactions.

Unified experience platform links feedback across enterprise systems.

Timeline profiles map complete interaction histories for omnichannel personalization.

Deep analysis uncovers root causes behind experience gaps.

Role-specific dashboards and alerts drive targeted decision-making.

7. Segment

Segment shines at collecting and routing user analytics across apps and warehouses, ideal for retail, finance, and health sectors that need real-time data flows. It offers a unified API for building customer profiles, ensuring privacy while enabling marketing and product teams to act on insights effectively.

Key Features

Engage tool builds dynamic audiences for personalized journeys.

Governance protocols maintain data quality and regulatory adherence.

Privacy safeguards comply with GDPR and similar standards.

Broad integration library connects to analytics, CRM, and ad platforms.

Reverse ETL pushes warehouse data back to operational tools.

8. Sitecore

Sitecore captures and activates data from web, apps, and devices to deliver a holistic customer perspective, supporting ecommerce and finance with AI personalization. It breaks down silos, ensures clean data, and supports compliant, scalable experiences across channels.

Key Features

AI-driven tailoring scales interactions to individual behaviors.

Automated cleansing keeps data reliable and up to date.

Built-in security meets global privacy regulations such as GDPR.

Ecosystem ties enhance personalization within the Sitecore suite.

Advanced segmentation handles large datasets for precise targeting.

9. Totango

Totango delivers AI insights and adaptable workflows for customer retention and growth, with predictive churn detection for startups. Its intelligence engine aligns sales and success teams, maximizing ROI through customizable success paths.

Key Features

Pre-built templates accelerate proven success tactics.

Multi-factor health scoring evaluates engagement holistically.

Grouping tools enable targeted outreach and strategies.

Shared goal plans foster customer alignment and progress.

Automated alerts trigger actions in response to churn signals.

10. Keap

Keap combines CRM and automation to organize customer journeys for small enterprises, streamlining sales, marketing, and other tasks. It tracks interactions and opportunities, freeing owners to prioritize expansion over admin work.

Key Features

Tag-based grouping refines contact lists for targeted campaigns.

Auto-generated tasks and scheduling prevent oversights.

Campaign tracking measures opens, clicks, and responses.

The mobile app provides full remote access to data.

Lead scoring prioritizes hot prospects automatically.

11. Customer.io

Customer.io allows product and marketing teams to use drag-and-drop builders for multi-channel campaigns, emphasizing data control and personalization. It integrates real-time data for segments and tests, boosting engagement without heavy coding.

Key Features

Precise grouping from diverse data sources for targeting.

In-app alerts engage users contextually during sessions.

Robust APIs enable custom tracking and connections.

Dynamic templating adapts messages to user specifics.

A/B testing optimizes campaign performance iteratively.

12. Adobe Real-Time CDP

Adobe Real-Time CDP aggregates behavioral and profile data from Adobe and external sources into instant profiles, helping marketers across diverse sectors with cookieless personalization. It stresses governance, enabling rapid audience activation while upholding privacy across online and offline touchpoints.

Key Features

Compliance tools manage data usage and regulatory needs.

Partner collaboration identifies audiences without sharing raw data.

Smooth links distribute info to experience platforms.

AI helper automates tasks and refines data workflows.

Unified profiles blend sources for enriched segmentation.

13. Salesforce Data Cloud

Salesforce Data Cloud fuses data into 360-degree views for sales, service, and marketing, leveraging AI models for tailored interactions. It tackles silos by enabling real-time access, supporting industries with secure, scalable profiles and predictive tools.

Key Features

Direct connectors access external data without copies.

Semantic search pulls meaningful records for AI apps.

Isolated sandboxes test changes safely.

Policy controls enforce access and audit compliance.

Flexible merging rules create accurate identities.

14. Tealium AudienceStream

Tealium AudienceStream CDP transforms disparate data streams into a single, actionable customer view, ideal for retail, finance, and healthcare sectors pursuing precise personalization. It leverages extensive tag management and real-time processing to connect with numerous marketing tools, enabling predictive actions that boost engagement and business decisions.

Key Features

Visitor stitching combines known and anonymous data to create complete profiles.

No-code audience tools simplify segment creation and management.

Event framework upholds data quality and governance standards.

Consent integration ensures privacy regulation compliance.

Trends visualization tracks audience shifts over custom periods.

15. Emarsys

Emarsys drives AI-fueled omnichannel campaigns by consolidating data for dynamic, behavior-responsive interactions across email, web, and mobile. It equips marketers with unified dashboards to monitor sales impacts and KPIs, fostering loyalty through smooth, timely outreach.

Key Features

Intelligent automation predicts and reacts to user patterns.

Multi-source integration yields holistic customer overviews.

Consistent delivery maintains messaging unity over channels.

Loyalty programs tailor retention via targeted incentives.

Dynamic profiling refines campaigns in real time.

16. Treasure Data

Treasure Data merges first-, second-, and third-party data into Diamond Records to enable AI-enhanced customer connections across automotive, retail, and healthcare. Its marketing cloud tools activate insights rapidly, streamlining engagement and boosting returns on customer initiatives.

Key Features

A hybrid setup blends cloud and on-site data flexibly.

Zero-copy access analyzes without data relocation.

AI workflow builder constructs automated strategies.

Vast connectivity spans analytics and CRM systems.

Insights widgets extract patterns from complex datasets.

17. Zeta

Zeta unifies diverse data into live profiles using low-code interfaces and AI enrichment, serving retail, travel, and finance to drive acquisition and retention gains. Its identity resolution turns unknowns into engageable contacts, minimizing IT burdens while maximizing campaign precision.

Key Features

Broad ecosystem links apps and channels effortlessly.

Identity linking expands profiles from first-party inputs.

Predictive signals augment data for sharper targeting.

Low-latency orchestration spans marketing touchpoints.

Visual builders craft journeys without deep coding.

18. Optimove

Optimove liberates marketers with positionless, AI-orchestrated campaigns that adapt via clustering and real-time tweaks across digital platforms. It aggregates data to deliver granular insights, enabling role-free execution that complies with privacy regulations and amplifies revenue through relevance.

Key Features

Multi-source aggregation forms reliable customer snapshots.

Marketer-led controls reduce engineering dependencies.

API sharing extends data to external marketing stacks.

Clustering analytics segments for hyper-targeted outreach.

Autonomous detection spots opportunities without scans.

19. mParticle

mParticle functions as a composable hybrid CDP that synchronizes real-time data to enable adaptive experiences across multi-channel brands, minimizing engineering demands. It excels in predictive intelligence and segmentation, enabling continuous refinement of customer journeys to enhance engagement and efficiency.

Key Features

Consolidated profiles deliver clean, integrated data as a trusted hub.

Instant profile access powers on-the-fly personalization.

Enterprise security includes identity matching and consent handling.

Over 300 connections unify existing tech environments.

Anomaly dashboards track KPIs and flag irregularities.

20. Rudderstack

Rudderstack operates as a warehouse-first CDP, channeling journey data into unified views and integrating with over 200 tools for privacy-focused personalization. It supports marketing, sales, and support by cleansing, segmenting, and activating data in real time across channels.

Key Features

Multi-channel collection builds thorough customer pictures.

Deduplication and merging ensure data consistency.

Behavioral grouping occurs live for demographic targeting.

Continuous processing keeps interactions current.

Reverse ETL and transformations prep data for destinations.

21. Pimcore CDP

Pimcore CDP centralizes profiles through automated merging and modeling, ideal for retail, manufacturing, and healthcare, pursuing omnichannel personalization. Its open-source flexibility and AI analytics cut costs while delivering real-time insights for refined marketing.

Key Features

Source blending removes duplicates for singular truths.

Activity-based grouping enables precise campaigns.

Custom modeling structures data to fit operations.

Interaction analytics inform performance decisions.

REST services link features across applications.

How should governance and operational reliability shape selection?

Demand attribute-level consent controls, role-based entitlements, and clear audit trails as baseline requirements. Evaluate how each platform separates compute and storage, whether it prevents raw customer data from being exposed to training pipelines, and whether it supports policy-only sandboxes for testing. Operationally, look for SLAs around match rate and ingestion latency, plus observability for schema drift and pipeline failures.

What do adoption and cost signals tell you about market direction?

Adoption is widespread enough that the question is no longer whether to have a CDP, but which kind of CDP fits your operating model, with over 70% of enterprises having adopted a customer data platform to enhance their marketing strategies — GrowthLoop Blog. Practically, that means procurement teams should move beyond feature checklists and insist on proof-of-outcome pilots tied to a single business metric before committing.

One concrete pilot design you can run this quarter

Run a four to eight-week pilot focused on a single actionable use case, instrument three metrics (signal freshness, downstream automation success, and time-to-resolution), and require rollback-ready transformations and replay tests. That constraint forces vendors to show operational readiness, not glossy dashboards. You can keep comparing features, but the real question is which platform will actually finish the work you need done.

What are the Features to Consider When Choosing an Enterprise Customer Data Platform?

Start by picking features that you can measure and hold to an SLA, not features that sound good on a slide. If a CDP cannot prove profile freshness, end-to-end latency, connector reliability, identity accuracy, and governance automation, it will cost you time and trust as you scale.

How do you test profile freshness in the real world?

Run a decay-and-replay test that mirrors live behavior. Create a representative cohort, replay historical events, then inject new events and check attribute TTL, enrichment latency, and merge outcomes. Treat freshness like a service level: define acceptable staleness for key fields, run hourly audits for high-value attributes, and fail fast on attribute drift. That level of rigor matters because, according to Layerfive Blog, 90% of marketers believe a unified customer view is critical for personalization, which means stale profiles are not just inconvenient; they actively undermine personalization and erode confidence.

What acceptance criteria prove real-time processing is production-ready?

Specify measurable thresholds, then test them. Measure median and p95 end-to-end event latency, duplication rates, out-of-order tolerance, and how queues behave under backpressure. Run load tests at realistic spikes and validate that scoring, triggers, and downstream activations occur within your defined window. Don’t accept vendor claims about “near real-time.” Force a replay: inject 10,000 events with mixed schema versions, then verify rule execution, alerts, and rollback behavior under error conditions.

How should you vet connector quality and maintenance burden?

Audit connectors the way you would audit suppliers. Check for automatic credential rotation, schema versioning, error telemetry, and a documented rollback path. Require a canary deployment for each new connector and monitor failure modes for 48 to 72 hours before complete cutover. Expect connectivity to be included in maintenance tasks; build a brief runbook that lists who handles expired tokens, who handles schema drift, and how incidents escalate. Think of connectors like plumbing: a single slow joint can throttle the whole building.

Most teams manage this by exporting CSVs and gluing scripts together because it is familiar and quick. That works for a pilot but scales poorly as sources multiply and compliance demands tighten. As the number of stakeholders grows, manual handoffs create blind spots and silent errors that surface only during quarters or renewals. Platforms like Coworker provide an alternative path, centralizing cross-app context in persistent memory and prebuilt connectors, then executing follow-up tasks with audited routing and role-aware permissions, reducing coordination time from multiple business days to under one workday while maintaining an auditable trail.

Which identity tests expose the trickiest match risks?

Create synthetic alias families and run merge-unmerge cycles against your identity engine. Test deterministic matches first, then layer probabilistic fuzzing for device and cookie signals. Measure false-positive merge rates and the human cost to resolve them. Require graph-based explainability so you can trace why two records merged, and insist on safe rollback primitives that unmerge without data loss. Identity is not a one-time process; it is continuous, observable, and reversible.

What governance checks must be automatic, not manual?

Validate consent propagation, attribute-level masking, and deletion workflows end to end. Automate policy gates at the connector layer so data never flows into downstream activations unless consent tokens validate it. Run a quarterly privacy drill: request a sample profile deletion and confirm that every downstream system honors the request within your SLA. That kind of rehearsal keeps audits from becoming trauma. And remember, these checks are part of ROI, because CDP.com, 60% of businesses achieve a return on investment within the first year of implementing a CDP, which underscores that governance and speed-to-value go hand in hand.

How do you validate segmentation and activation pipelines without breaking production?

Backtest segments against a holdout and run small randomized experiments before activating broadly. Implement circuit breakers on noisy triggers and require a minimum sample size for lookback windows. Export segment definitions as code so they can be versioned, reviewed, and rolled back. Activation readiness is about two things: accuracy and safety; you need both before you trigger downstream workflows.

How can analytics dashboards be stress-tested for trust?

Treat dashboards like contracts with stakeholders. Add automated checks that compare derived KPIs to source values, surface sudden shifts with root-cause links to upstream events, and include replayable scenarios so product and finance can validate numbers against historical runs. Build alerts that explain why a metric moved, not just that it moved; context is the difference between a false alarm and a solvable problem. Profiles should feel alive, not archival. Think of a CDP as the building’s electrical panel, not the fuse box you poke when the lights go out; you want predictable breakers, labeled circuits, and an operator who can reroute power without blowing the whole floor. That simple oversight hides a more complicated truth.

Related Reading

How to Choose the Right Enterprise CDP For Your Goals

Pick the CDP that forces vendors to prove outcomes, not just demonstrate features, by insisting on contractual SLAs, realistic acceptance tests, and a transparent handoff to your operations team within the first 90 days.

What contractual guarantees should I demand?

Start with measurable promises. Insist on uptime and ingestion SLAs tied to financial credits, explicit match-rate and duplicate-rate thresholds, guaranteed connector maintenance windows, and a termination clause that includes a verified data export in production-ready formats. Add a clause that forbids vendor training on raw customer content and requires cryptographic key control or bring-your-own-key, and need a quarterly privacy drill where a sample deletion request must be honored across all downstream systems within your SLA, with documented proof.

How do you design acceptance tests that actually prove production readiness?

Build a three-part acceptance test: synthetic replay, live needle test, and a resilience scenario. For the replay, run a known six-month window of events through vendor transforms and compare derived features to your canonical values, with an allowable drift rate defined up front. For the needle test, stage a small cohort and trigger a complex workflow that touches at least three systems, then measure end-to-end time, false-merge rate, and the percent of actions completed without manual intervention. To demonstrate resilience, simulate connector failures and schema drift, then confirm automatic queueing, alerting, and safe rollback within agreed-upon windows. Require pass/fail thresholds; do not accept vague assurances.

Who should own the CDP inside the company, and what do they do?

Create a small, accountable team: a CDP product owner with business KPIs, a data steward who owns identity and schema contracts, an integrations engineer responsible for connector health, and a privacy officer for consent and retention rules. Set clear 30/60/90-day milestones: first 30 days, connectors and test data; 60 days, acceptance tests and one live playbook; 90 days, an audited production run with SLAs verified. Track operational metrics like time-to-detect pipeline failures and mean time to remediate, not just vanity adoption numbers.

Most teams handle procurement by comparing feature checklists because it feels quick and objective. That familiarity hides a quiet cost: once the contract is signed, feature gaps turn into engineering work, and the business pays in time and scope creep. Platforms like Coworker change that path, because teams find the OM1 memory and cross-app connectors behave like an operational layer that can be contractually validated during a pilot, compressing multi-team coordination from days to hours while keeping a complete audit trail.

What pricing structure aligns vendor incentives with your goals?

Prefer outcome-aligned models or hybrid pricing that mixes a baseline connector/ingestion fee with credits tied to SLA attainment. Hence, vendors share the risk of integration and stay motivated to maintain quality. Require fixed-price migrations for the pilot and an explicit price schedule for incremental profiles or event volume, with caps and predictable overage tiers. Add performance credits for missed SLAs and require free export tooling and one month of migration assistance on termination to avoid lock-in.

Why measure business impact before full rollout?

Because hard outcomes win internal support, tie the pilot to one clear business metric, instrument it, and date-box the evaluation. That matters because CDP.com reports that 75% of enterprises say a CDP has improved their data-driven marketing campaigns (2022), which shows pilot wins often come from focused, measurable use cases. Also, insist the vendor demonstrate lift on an engagement metric during the pilot, since CDP.com, Enterprises using a CDP see a 30% increase in customer engagement, 2022, and you should expect to see directional movement before you scale spend.

Think of the contract and pilot like leasing a courier fleet, not buying a single van. You want the service plan, guaranteed route times, spare drivers, and a clause that replaces the van if it fails; otherwise, you are left improvising with personal contacts and one-off fixes. That simple set of procurement and operational rules makes selection objective and reduces the risk that implementation becomes a project that quietly never ends. The surprising part? The next decision you make after selecting a vendor will reveal more about your readiness than the vendor ever will.

Related Reading

Sierra Alternatives

Freshworks Alternatives

Catalyst Vs Gainsight

Totango Competitors

Book a Free 30-Minute Deep Work Demo

When we audit handoffs across mid-market customer success teams, the pattern is the same: context fragments, work stalls, and people spend more time chasing information than solving customer problems. If you want to reclaim those hours, let's explore Coworker, where enterprise AI agents and an operational CDP approach turn unified profiles and cross-app signals into executed work, like handing routine tasks to a reliable assistant, and you can see it in a free deep work demo.

Do more with Coworker.

Coworker

Make work matter.

Coworker is a trademark of Village Platforms, Inc

SOC 2 Type 2

GDPR Compliant

CASA Tier 2 Verified

Links

Company

2261 Market St, 4903 San Francisco, CA 94114

Alternatives

Do more with Coworker.

Coworker

Make work matter.

Coworker is a trademark of Village Platforms, Inc

SOC 2 Type 2

GDPR Compliant

CASA Tier 2 Verified

Links

Company

2261 Market St, 4903 San Francisco, CA 94114

Alternatives

Do more with Coworker.

Coworker

Make work matter.

Coworker is a trademark of Village Platforms, Inc

SOC 2 Type 2

GDPR Compliant

CASA Tier 2 Verified

Links

Company

2261 Market St, 4903 San Francisco, CA 94114

Alternatives